Union Investment Group

Union Investment was established in 1956. We are an active German asset manager based in Frankfurt am Main, offering a comprehensive range of investment solutions across asset classes and regions.

Our aim is to achieve the optimum balance between security and return, thereby generating additional income for our clients over the long term. Our team of over 180 investment professionals focuses on developing customised investment solutions to meet our clients' needs. We offer investment vehicles for private and institutional investors, as well as customised solutions through individual mandates.

Our institutional clients include banks, pension funds, insurance companies, religious institutions, industrial companies and non-profit organisations such as foundations and associations. We pursue the investment objectives of our institutional investors consistently and successfully with clearly defined, consistent investment strategies.

One company, one goal

Our mission is to grow investors' assets

Shareholder structure

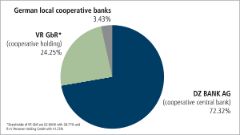

Union Investment is the dedicated asset manager within the German cooperative financial network. All shareholders are also part of the network, which ensures a stable and long-term ownership structure. This allows us to maintain a sustainable business model and develop strong, long-term client relationships.

Cooperative financial network

Union Investment is the asset manager within the German cooperative financial Network.

Investment philosophy

Our investment philosophy is based on our belief that markets are inefficient. Long-term outperformance is, therefore, best achieved through a combination of fundamental research, actively managed security selection and robust risk management. This conviction lies at the heart of all our investment solutions. We offer a transparent investment process, which allows clients to keep track of our investment decisions.

We take an integrated approach to portfolio management, with every portfolio manager also acting as a senior research specialist. This structure enhances the team’s commitment to the process and helps to ensure accountability for investment performance.

As active asset managers, we work for your investment

Current assets under management, as of 31 March 2023

Assets under Management (total):

424.1 bn. euros

thereof institutional assets:

226 bn. euros

The assets we manage are widely diversified

| Fixed Income* | 158.1 |

| Equity | 106.5 |

|

Real Estate, infrastructure and alternative investments** |

65.3 |

| Other*** | 80.6 |

| Liquidity**** | 13.6 |

| Totalling | 424.1 |

- * Including money market instruments

** Including commodities

*** Including asset management mandates, investment funds from external providers, and non-allocated advisory mandates

**** Overnight and time deposits

More than 60 years' experience: Union Investment Group

The markets are moving at an ever faster pace, and investors' needs and wishes are changing accordingly. For us, clientes' wishes always come first, and we seek out innovative solutions to bring them to fruition.

Protecting investors is our priority

We manage the assets of investors in trust. That is why we offer investors a high level of protection by safeguarding their assets, setting high standards for ourselves as well as in collaboration with third parties. For example, we adhere to the code of conduct of the Federal Association of German Fund Management Companies (BVI) and engage in critical dialogue with companies in which we invest – for the purpose of good and responsible corporate governance.

We see ourselves as an active investor that champions good and responsible corporate governance for the benefit of our customers. After all, well-managed companies offer investors greater opportunities for rewards with lower risks, thus underpinning their trust in investing in securities.

What we do to protect investors

Sustainability born of tradition

Our activities have been based on sustainable and socially responsible business since our establishment in 1956. The responsibility that we assume is twofold: offering sustainable products and services and doing business sustainably. Within the company, we seek to ensure sustainability in relation to the environment, employees, corporate citizenship and procurement.

We believe sustainability has three dimensions: ethical, social and environmental.

The importance of sustainability to us can be seen from the fact that we offer sustainable solutions to our customers in all areas. We invest in eco-friendly real estate, give institutional clients the option to define screening criteria for their portfolio investments and offer funds focused on socially responsible investments to retail clients.

.png)